Preference share capital P10 par 4 cumulative 25000 shares issued and outstanding. Issued and outstanding 1000000.

Issued and outstanding 1000000.

. Ute reported net income of 500000 for the year ended December 31 Year 2. Ute reported net income of 500000 for the current year ended December 31. Ute reported net income of 500000 for the year ended December 31 Year 2.

Ute reported net income of 500000 for the year ended December 31 Year 2. Common stock 5 par 200000 shares. Had the following capital structure during Year 1 and Year 2.

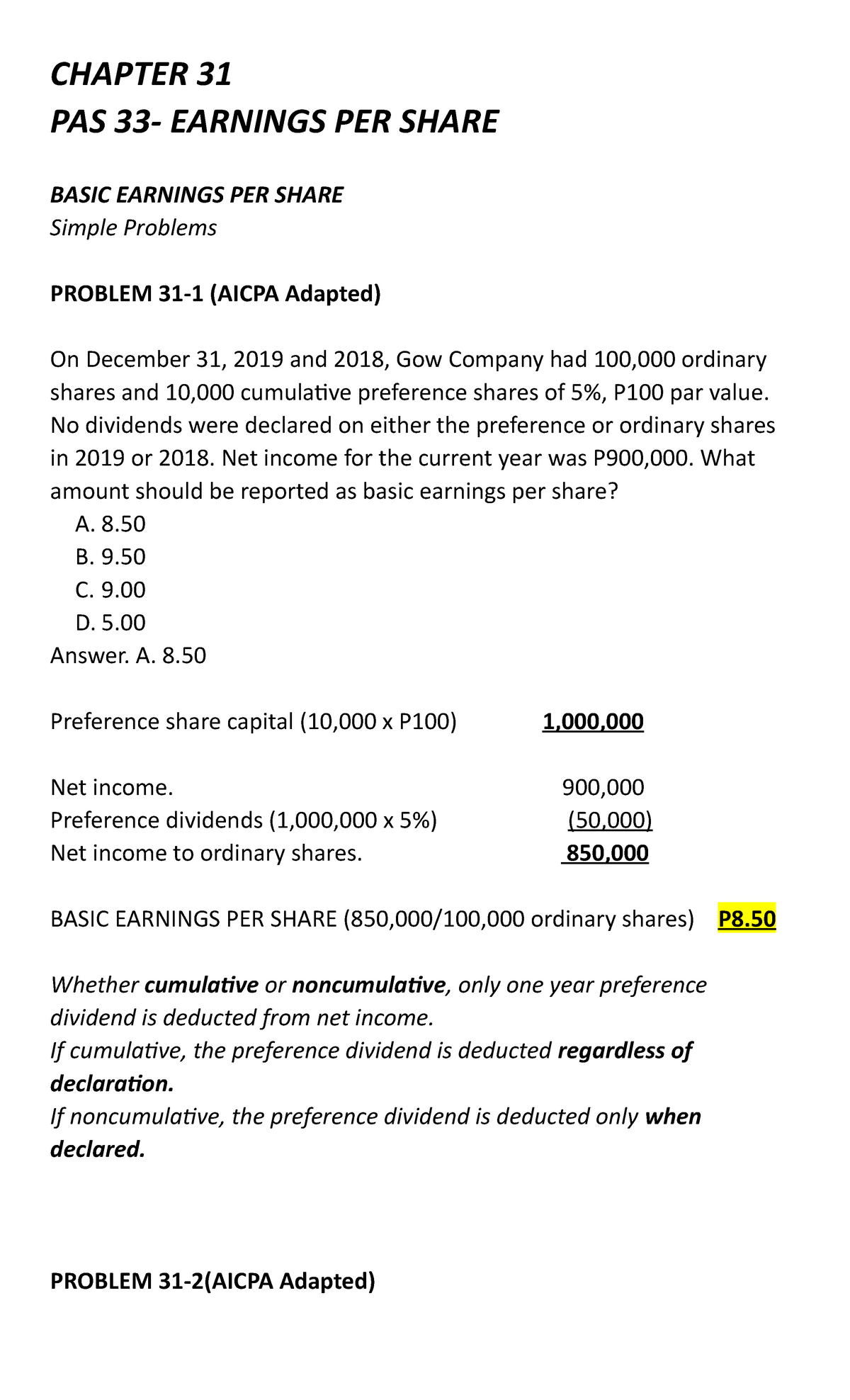

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding. Had the following capital structure during Year 1 and Year 2. The preference dividend is ignored because the preference shares are redeemable and considered as financial liability.

Had the following capital structure during Year 1 and Year 2. PROBLEM 31-3 AICPA Adapted Ute Company had the following capital structure during 2019. Had the following capital structure during Year 1 and Year 2.

Preferred stock 10 par 4o cumulative 25000 shares issued and outstanding Common stock 5 par 200 000 shares issued and outstanding 250000 1000000 Ute reported net income of 500000 for the year ended December 31 Year 2. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding. Ute Company had the following capital structure during 2019.

Had the following capital structure during Year 1 and Year 2. Common stock 5 par 200000 shares. Ute paid no preferred dividends during Year 1.

Had the following capital structure during Year 1 and Year 2. The entity reported net income of P5000000 for the current year. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 The preferred stock is not convertible.

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000. Ute paid no preferred dividends during Year 1 and paid. Ute paid no preferred dividends.

Ute paid no preferred dividends during 20X1 and paid 16000. Ute reported net income of 500000 for the year ended December 31 Year 2. Had the following capital structure during Year 1 and Year 2.

Common stock 5 par 200000 shares. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 Ute reported net income of 500000 for the year ended December 31 Year 2. Ute Company had the following capital structure during 2014 and 2015.

Preference share capital P100 par 4 cumulative 25000 shares issued and outstanding 2500000 Ordinary share capital P50 par 200000 shares Issued and outstanding 10000000. Issued and outstanding 250000. Had the following capital structure during Year 1 and Year 2.

Ute reported net income of 500000 for the year ended December 31 Year 2. Preferred stock 10 par 4 cumulative 25000 shares. Common stock 5 par 200000 shares issued and outstanding 1000000.

Common stock 5 par 200000 shares issued and outstanding 1000000. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 Ute reported net income of 500000 for the year ended December 31 Year 2. Had the following capital structure during 20X1 and 20X2.

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 Ute reported net income of 500000 for. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000. Had the following capital structure during Year 1 and Year 2.

Preferred stock 10 par 4o cumulative 25000 shares issued and outstanding Common stock 5 par 200 000 shares issued and outstanding 250000 1000000 Ute reported net income of 500000 for the year ended December 31 Year 2. The preferred stock is not convertible. Ute paid no preferred dividends during Year 1 and paid 16000 in.

Ute reported net income of 500000 for the year ended December 31 Year 2. 250000 Common stock 5 par 200000 shares issued and outstanding. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 The preferred stock is not convertible.

Had the following capital structure during Year 1 and Year 2. Preference share capital P10 par 4 cumulatve 25000 shares issued and outstanding 250000 Downloaded by Yha Mae Toledo email protected lOMoARcPSD9687264. Ute Company reported the following capital structure during the current year.

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 The preferred stock is not convertible. Common stock 5 par 200000 shares issued and outstanding. Preference share capital P10 par 4 cumulative 25000 shares issued and outstanding 250 Ordinary Share capital P5 par 200000 shares Issued and outstanding 1000 The entity reported net income of P500000 for the year ended December 31 2015.

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000. Preferred stock10 par 4 cumulative 25000 shares issued and outstanding Common stock 5 par 200000 shares issued and outstanding Ute reported net income of 1000000 for the year ended December 31 19X4. Had the following capital structure during Year 1 and Year 2.

Issued and outstanding 1000000. Ute reported net income of 500000 for the year ended December 31 20X2. I have a question about calculating the basic EPS.

Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000 Common stock 5 par 200000 shares issued and outstanding 1000000 Ute reported net income of 500000 for the year ended December 31 20X2. Had the following capital structure during 19X3 and 19X4. Had the following capital structure during 20X1 and 20X2.

Had the following capital structure during Year 1 and Year 2. The preferred stock is not convertible. Had the following capital structure during 19X3 and 19X4.

Ute reported net income of 500000 for the year ended December 31 19X4. Preferred stock 10 par 4 cumulative 25000 shares issued and outstanding 250000. Preference share capital P10 par 4 cumulative 25000 shares issued and outstanding 250000 Ordinary Share capital P5 par 200000 shares Issued and outstanding 1000000 The entity reported net income of P500000 for the year ended December 31 2015.

Ute paid no preferred dividends during 19X3. Had the following capital structure during the previous and current years. 1000000 The preferred stock is not convertible.

Problem 28-5 Ute Company had the following capital structure during 2014 and 2015.

Problem 28 5 Ute Company Had The Following Capital Structure During 2014 And Course Hero

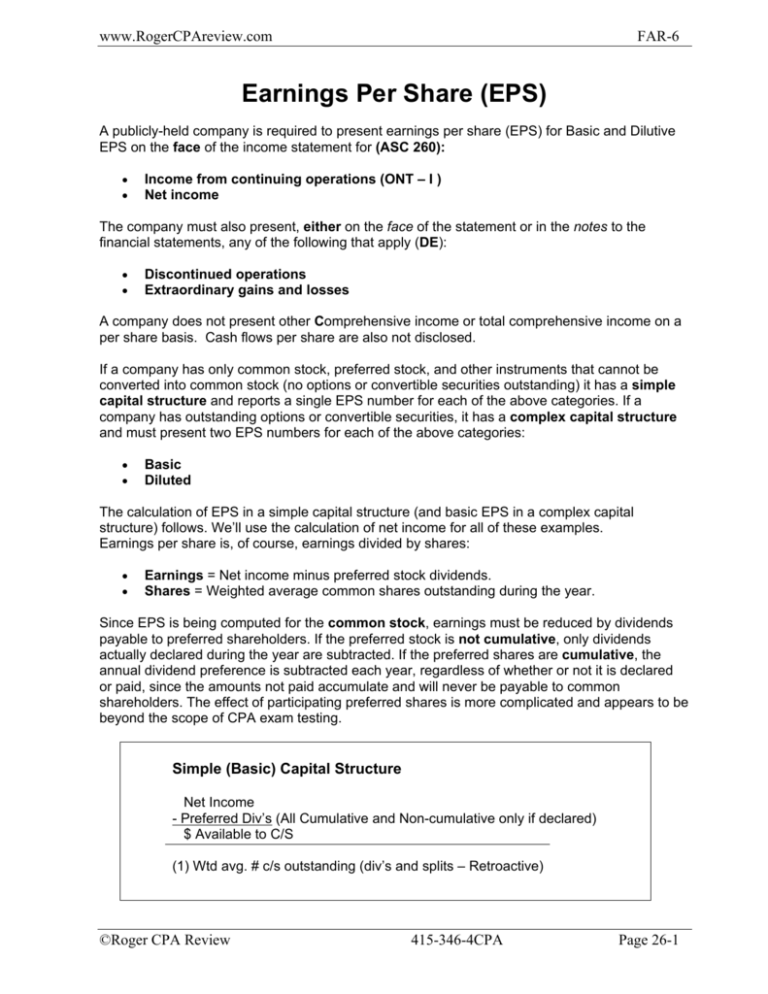

Pas 33 Earnings Per Share Chapter 31 Pas 33 Earnings Per Share Basic Earnings Per Share Simple Studocu

0 Comments